This is just sad. Normal inflation is 2-5%. The Fed actually targets 2% and has had to actively stimulate the economy post 2008 just to achieve 2% (below is bad, not good). I’ve acknowledged in several posts that the current inflation of 6.8% is slightly above normal. That is a far cry from the media outrage directed at it. What is clear is that people have a political interest in making this a bigger issue than it actually is.>says Normal being 2-5%

>inflation being at 4% or above has literally not been seen in 40 years which was during an era called.... the great inflation

>even during the worst recession in modern times we were at 3.8% before being due for a correction

There is an issue here. I have no idea where you got the idea that normal is 2-5% since clearly it isn't where most years since 1980s we've seen 0-2% except for the periods that there was a recession or a bubble popping (dot com bubble, great recession, black Monday) which would more likely show that we're due for a correction ie crash soon.

Not to mention that you completely ignored the parts where I showed 1980s inflation rate is different than 2021s inflation rate. If you apply 1980's inflation rate to 2021 or vice versa, you'll see a drastically different story.

There's still the obvious issue that the inflation has not been stopping. Even in 2008, it "only" rose to 5.8% before quickly dropping due to the Great Recession. Whereas now, the inflation numbers are going past that level, and it's showing no signs of stopping, and it's safe to assume that sooner rather than later there will be some sort of disaster impending. Whether that be supply chain issues, real estate market going kaboom in CN, a looming endemic, student loans, etc there is cause for concern.

Something something, inflation is transitory. Billionaire's investments =/= economy just fyi.

-

Welcome to Smogon! Take a moment to read the Introduction to Smogon for a run-down on everything Smogon, and make sure you take some time to read the global rules.

-

Congrats to the winners of the 2023 Smog Awards!

Headlines “Politics” [read the OP before posting]

- Thread starter vonFiedler

- Start date

- Status

- Not open for further replies.

Inflation past 7% is definitely normal relative to the rest of the developed world right now, given supply chain disruptions and oil production cuts. The inflation of today is from a cataclysmic event affecting the global population, and from oil production cuts. This makes for a far more dangerous situation, but also demonstrative of how far the US has come in macroeconomic (especially monetary) policy. It also serves as an indictment of Nixonian policies that served as the basis and direction of Trump's own policy. Biden is being forced on a similar footing to Jimmy Carter, having to fight the inflationary pressures caused by his predecessor's policies while facing the entirety of the political fallout of said inflation.

long term, the US is fine. If any country should be worried about inflation, it's Turkey expanding from 35+% to hyperinflation over the next quarter. Inflation is normal during periods of high consumption. In the past year that's exactly what's happened in US markets, which have seen indexes like the DOW Jones of S&P double or almost double in 2 years. I doubt we're going to see a "correction" so much as dwindling growth in the next few months as the US hikes rates.

In contrast, Turkey is pursuing policies that will intentionally inflate prices, including pursuing a 0% interest rate. As to why, that is (according to international observers) better explained as prevailing irrationality in fascist policies and those of similar authoritarian populist movements. I'm referring to the reasoning provided by Erdogan and accepted by international media, which is that he's pursuing economic policies in accordance with fundamentalist beliefs in Islam. But IMO this is more motivated by a desire to see greater socioeconomic stratification. In other words, to make the average Turk too impoverished to wage meaningful resistance against a modernised military. I still think it'll backfire into persistent hyperinflation though

long term, the US is fine. If any country should be worried about inflation, it's Turkey expanding from 35+% to hyperinflation over the next quarter. Inflation is normal during periods of high consumption. In the past year that's exactly what's happened in US markets, which have seen indexes like the DOW Jones of S&P double or almost double in 2 years. I doubt we're going to see a "correction" so much as dwindling growth in the next few months as the US hikes rates.

In contrast, Turkey is pursuing policies that will intentionally inflate prices, including pursuing a 0% interest rate. As to why, that is (according to international observers) better explained as prevailing irrationality in fascist policies and those of similar authoritarian populist movements. I'm referring to the reasoning provided by Erdogan and accepted by international media, which is that he's pursuing economic policies in accordance with fundamentalist beliefs in Islam. But IMO this is more motivated by a desire to see greater socioeconomic stratification. In other words, to make the average Turk too impoverished to wage meaningful resistance against a modernised military. I still think it'll backfire into persistent hyperinflation though

Some strong economic numbers came out in January. Unemployment is down, wages are up, GDP has skyrocketed.

.....yet Biden's approval rating just keeps getting worse.

We live in a fact-free universe.

.....yet Biden's approval rating just keeps getting worse.

We live in a fact-free universe.

it's almost like an abstractly/narrowly understood 'strong economy' doesn't really mean very much for a significant amount of people.Some strong economic numbers came out in January. Unemployment is down, wages are up, GDP has skyrocketed.

.....yet Biden's approval rating just keeps getting worse.

We live in a fact-free universe.

Well, I wouldn't expect the general public to understand the intricacies economic metrics.it's almost like an abstractly/narrowly understood 'strong economy' doesn't really mean very much for a significant amount of people.

However, the media coverage of the "Biden economy" has been nothing short of atrocious. It is the media's job to report on the facts. The media has spent months pushing the Biden's presidency is a disaster narrative when economically that is complete bullshit. They are so biased it isn't even funny anymore.

it's almost like an abstractly/narrowly understood 'strong economy' doesn't really mean very much for a significant amount of people.

There’s also plenty to be said about the fact that just because the statistics are talking, it doesn’t mean they’re talking for the majority of people, or that the jobs that people have been able to find are actually sufficient in tending to food and housing needs/insecurity.Well, I wouldn't expect the general public to understand the intricacies economic metrics.

However, the media coverage of the "Biden economy" has been nothing short of atrocious. It is the media's job to report on the facts. The media has spent months pushing the Biden's presidency is a disaster narrative when economically that is complete bullshit. They are so biased it isn't even funny anymore.

View attachment 405672

I haven't read this thread at all, but saw this comment and genuinely can't tell if serious. I remember writing "I read the Economist" on the personal statement for my University application 18 years ago and I still cringe about it.maybe if you had a degree in economics you would understand that biden is doing an AMAZING job

i read the economist

Anyway, Biden's hands are tied, and the macroeconomic situation is such that the powers that be are damned if they do and damned if they don't. QE is frankly a game where the only winning move is not to play, but here we are 13 years later with the dollar-backed-world in a more precarious situation than in 2009 because political expedience kicked the can down the road. We're all witnesses to the slowest train wreck that is this global edifice of debt. Inflation/stagflation is here to stay because it's the least painful way for governments to service their debt, and of course it's at the expense of the middle class (diminished real savings) and the poor (regressive stealth tax).

Maybe you missed his entire point but 2-5% inflation is literally not normal. We have literally never seen inflation go above 4% under our current calculation methodology, and we have only seen it go above 2% a handful of times in the last 30 years.This is just sad. Normal inflation is 2-5%. The Fed actually targets 2% and has had to actively stimulate the economy post 2008 just to achieve 2% (below is bad, not good). I’ve acknowledged in several posts that the current inflation of 6.8% is slightly above normal. That is a far cry from the media outrage directed at it. What is clear is that people have a political interest in making this a bigger issue than it actually is.

6.8% is unacceptably high, and it is paired with real wage growth declines of 1-2%. In other words, although the wealthiest are starting to bounce back (seen via the stock market, at least prior to the recent correction), working people are worse off compared to last year around the tune of 8%. No shit Biden’s approvals are in the dirt - almost everyone is worse off than last year, and only the ultra wealthy are doing moderately ok.

This is totally wrong. The Fed actually targets 2% inflation, and has spent over 10 years printing a shit ton of money and holding interest rates at zero just to reach 2%. Inflation has been too low in recent history.Maybe you missed his entire point but 2-5% inflation is literally not normal. We have literally never seen inflation go above 4% under our current calculation methodology, and we have only seen it go above 2% a handful of times in the last 30 years.

No, 6.8% is slightly above normal. The Fed's published inflationary target is 2%. Moderate inflation is more helpful to an economy than inflation under 2%, that's why governments quite literally bend over backwards to inflate a stagnant economy.6.8% is unacceptably high, and it is paired with real wage growth declines of 1-2%.

You can try to spin whatever right-wing talking points you want. Wage growth over the last 50 years has nothing to do with President Biden, and more to do with supply side economic theory. In 2021, wage growth was about 4%, GDP was 7% and inflation was 7%. Let's stick to the facts.In other words, although the wealthiest are starting to bounce back (seen via the stock market, at least prior to the recent correction), working people are worse off compared to last year around the tune of 8%. No shit Biden’s approvals are in the dirt - almost everyone is worse off than last year, and only the ultra wealthy are doing moderately ok.

I've no interest in stepping into this shit throwing contest, but I do want to point out that calling 6.8% inflation "slightly above normal" in the context of near zero (negative in some places) base interest rates should absolutely be ridiculed. For perspective, 7.2% compounded would double the price of something in a decade.

It's true that year on year metrics have been distorted by unprecedented events in 2020, but inflation is unfortunately sticky and self-fulfilling, while GDP growth is not. Ignore for a moment that GDP actually just measures debt driven consumption, but 7% growth is very likely unsustainable. Meanwhile, the consequences of the lagged resolution to broken supply chains and global commodity shortages will be felt for a long time to come. For example, the collapse in new car sales for 2 years means that future used car supply will remain constrained, so both new and used prices will stay elevated.

Take a step back and recognise that we're all living through financial repression, and whether Biden can actually do anything to combat it, or whether politicians anywhere have the will to change course are the real questions that cynics already know the answer to.

It's true that year on year metrics have been distorted by unprecedented events in 2020, but inflation is unfortunately sticky and self-fulfilling, while GDP growth is not. Ignore for a moment that GDP actually just measures debt driven consumption, but 7% growth is very likely unsustainable. Meanwhile, the consequences of the lagged resolution to broken supply chains and global commodity shortages will be felt for a long time to come. For example, the collapse in new car sales for 2 years means that future used car supply will remain constrained, so both new and used prices will stay elevated.

Take a step back and recognise that we're all living through financial repression, and whether Biden can actually do anything to combat it, or whether politicians anywhere have the will to change course are the real questions that cynics already know the answer to.

Last edited:

Wait I don't get one thing.

How is making money worth less (not worthless, yet at least) a GOOD thing for the economy? Cause that's inherently what inflation is, printing money which then makes each individual dollar worth less, no?

Also, correct me if I'm wrong, I very may well be, but they don't include housing and such in the inflation standards I thought.

How is making money worth less (not worthless, yet at least) a GOOD thing for the economy? Cause that's inherently what inflation is, printing money which then makes each individual dollar worth less, no?

Also, correct me if I'm wrong, I very may well be, but they don't include housing and such in the inflation standards I thought.

Encourages the circulation of money, since people would want to spend now rather than later. This boosts economic growth. Also prevents deflation from happening, which isn't exactly good for the economy.Wait I don't get one thing.

How is making money worth less (not worthless, yet at least) a GOOD thing for the economy? Cause that's inherently what inflation is, printing money which then makes each individual dollar worth less, no?

Also, correct me if I'm wrong, I very may well be, but they don't include housing and such in the inflation standards I thought.

The debate about whether a "small" amount of inflation is a good thing remains an ongoing disagreement between different schools of thought, which will never be resolved. Money printing per se should not be equated with "inflation" in the most common understanding of the word (i.e. not Austrian), but rather that price inflation is a symptom of monetary expansion above output (e.g. money supply +$102 vs GDP +$100), which leads to debasement of the currency if excessive.Wait I don't get one thing.

How is making money worth less (not worthless, yet at least) a GOOD thing for the economy? Cause that's inherently what inflation is, printing money which then makes each individual dollar worth less, no?

Also, correct me if I'm wrong, I very may well be, but they don't include housing and such in the inflation standards I thought.

With that established, debasing/weakening the currency through expansionary monetary policy is beneficial for borrowers because now that the currency is worth less, debt denominated in that currency is also worth less i.e. paying off the same $100 of nominal debt is cheaper with a debased, weaker dollar.

Governments around the world routinely ran budget deficits prior to Covid, and the pandemic has only accelerated the accumulation of public and private debt. When you consider debt to GDP ratios everywhere, it should be no wonder that governments are resorting to inflation; there is a probability approaching zero that the world will grow its way out of this. As stated previously, inflation is the least painful and most politically expedient way to service debt, as it is a (regressive) stealth tax that is widely misunderstood.

Last edited:

Additionally, it's actually the case that many governments in the past have periodically tried to depreciate their currency's value for economic advantage (and many other countries have complained against that practice). Most WANT a weaker currency.Wait I don't get one thing.

How is making money worth less (not worthless, yet at least) a GOOD thing for the economy? Cause that's inherently what inflation is, printing money which then makes each individual dollar worth less, no?

Also, correct me if I'm wrong, I very may well be, but they don't include housing and such in the inflation standards I thought.

Ie. There’s actually a tipping point where if you try to depreciate your currency too much, your trade partners may cut you off or throw tariffs on you because you are too aggressively tipping the scale of who is more attractive to private investment etc.

China is a common example. If you undervalue your currency, your market becomes comparatively more attractive for foreign investment and development activities like contracting labor or setting up manufacturing. If your currency is cheaper, it becomes cheaper for foreigners to hire your workers, build plants in your country, manufacture and export from your country-- you know, base activities that tend to develop areas and improve living standards (given the right incentives regulations). Like, if you need well educated, well connected workers it's a lot cheaper to grant cash for schools and roads to a local government in a country with cheaper currency.

If you are an economy looking to SELL productivity to the world and buy less of the world's goods (probably the case if you live in an under developed area of even a rich country like the US) than having a weaker currency can definitely be a boon.

If you are an economy looking to BUY productivity than a stronger currency can help you do so for cheaper relatively.

And since many countries would rather be sellers than buyers (even rich countries like the US do not want to disadvantage their exports infinitely— if at all), would rather maintain trade surplus than deficit, be more attractive to foreign investment than do the foreign investing— there’s actually maneuvering, negotiation, retaliation to see how much currency depreciation a country can get away with.

While maintaining a sufficient/minimum buying power to get sufficient imports of materials for production and consumer goods needed to keep the citizenry from revolting— beyond that most countries in the world want to depreciate their currency as much as they can get away with.

This is an over simplification, but the point is that what's "good" for an economy is subjective (depends on what measures of "goodness" you are looking for towards the citizenry), and the benefit of stronger or weaker currency is contextual to what specific economic objectives you have in the local or country level or even personal level economy you are defining.

Last edited:

Wait I don't get one thing.

How is making money worth less (not worthless, yet at least) a GOOD thing for the economy? Cause that's inherently what inflation is, printing money which then makes each individual dollar worth less, no?

Also, correct me if I'm wrong, I very may well be, but they don't include housing and such in the inflation standards I thought.

Inflation is not synonymous with money printing. I’m not sure why this misconception is so widespread.How is making money worth less (not worthless, yet at least) a GOOD thing for the economy? Cause that's inherently what inflation is, printing money which then makes each individual dollar worth less, no?

Inflation is the general rise in prices of goods and services in an economy, which is a function of supply and demand. In the last 50 years, inflation has had a near perfect correlation with oil prices. When you peel back the layers it should be easy to understand-

rising oil prices increases the cost of manufacturing and distribution of said goods and services, as well as the heating and energy involved in housing products and the consumers of said products. This affects the entire economy.

There is no debate whatsoever between small inflation vs zero/negative inflation (“deflation”). Government policy shows they will literally bend over backwards to prevent deflation. If the currency becomes more valuable tomorrow, there is no reason to engage in economic activity today. Furthermore, existing debt becomes increasingly burdensome and untenable.The debate about whether a "small" amount of inflation is a good thing remains an ongoing disagreement between different schools of thought, which will never be resolved.

A simply analogy is monopoly. Imagine if the reverse were true; the bank collects $200 from each player for passing GO, rather than each player collecting $200. Activity would stagnate and all the players will eventually go broke.

Last edited:

The fact that an arbitrary x% inflation target is a politically expedient mandate and therefore put into practice doesn't mean that there isn't a debate. This is all just a grand 30 year experiment; the UK adopted an inflation target from 1992, with the Federal Reserve formally joining the party in 2012. In any case, they're clearly not following their own mandates anyway, because the one blunt tool that they have to control rising inflation with would be to significantly raise interest rates.There is no debate whatsoever between small inflation vs zero/negative inflation (“deflation”). Government policy shows they will literally bend over backwards to prevent deflation. If the currency becomes more valuable tomorrow, there is no reason to engage in economic activity today. Furthermore, existing debt becomes increasingly burdensome and untenable.

Last edited:

It has nothing to do with politics. An economy does not function long term without inflation.The fact that an arbitrary x% inflation target is a politically expedient mandate and therefore put into practice doesn't mean that there isn't a debate.

For those that cannot or will not accept this fact, show us the successful economies that use deflation as monetary policy.

That is exactly what all the countries in the developed world are currently discussing- How much and what timetable to increase interest rates. The fact that they have not yet jacked up interest rates impulsively should provide insight into how serious the inflation problem actually is.This is all just a grand 30 year experiment; the UK adopted an inflation target from 1992, with the Federal Reserve formally joining the party in 2012. In any case, they're clearly not following their own mandates anyway, because the one blunt tool that they have to control rising inflation with would be to significantly raise interest rates.

Last edited:

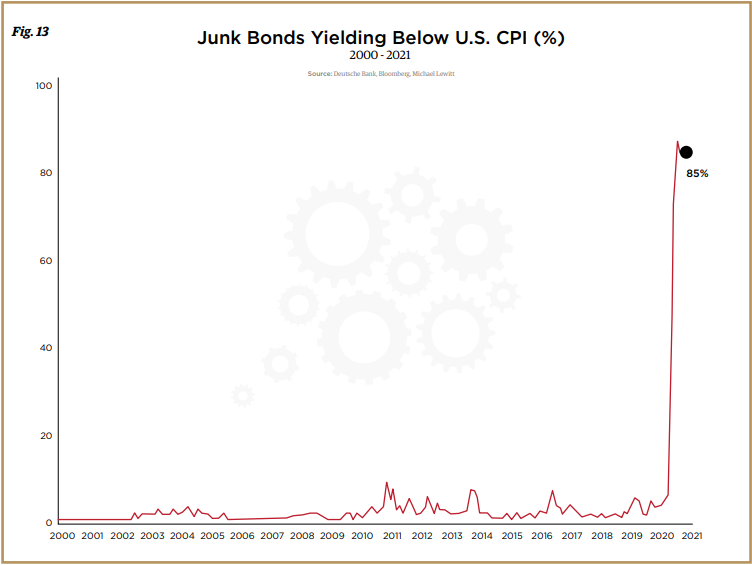

For the rest of you, bear in mind that this chart is now 4 months old and CPI has since increased:

Source for the curious: https://cdn.wealthion.com/Documents/TTMYGH_2021_10_The_Winds_Of_Change.pdf

Source for the curious: https://cdn.wealthion.com/Documents/TTMYGH_2021_10_The_Winds_Of_Change.pdf

Last edited by a moderator:

Again, show us how deflation is preferable to inflation and any country that has taken that approach.snip

As for Inflation vs oil prices, you can make your own conclusion:

Last edited by a moderator:

This is a strawman. I said that 6.8% inflation is not "slightly above normal". This is not the same as "deflation is preferable to inflation". You clearly know a little about economics, but that's the most dangerous amount of knowledge, because you end up spouting the kool aid from one school of thought as unquestionable fact on a Pokémon forum (I should know, I used to be that person 15 years ago). I am done here.Cool story and way to not address any of my points. It is clear you have an agenda to push. Again, show us how deflation is preferable to inflation and any country that has taken that approach.

Last edited by a moderator:

- Status

- Not open for further replies.